Do I Really Need A Prenup?

Spoiler: You probably do. But here’s why that’s not a bad thing.

by The Candidly Team

To dive into a marriage thinking about divorce might sound ominous.

We know that no one enjoys pressing pause to talk prenup amidst the tasting of cakes and the booking of tickets to Bali.

And yet, we also know that living in the moment shouldn’t come at the expense of punishing our future selves.

Half of marriages end in divorce, etc., etc. We won’t bore you with statistics. But we will share the most compelling piece of advice we’ve heard on the subject of whether or not to get a prenup.

It comes from Katie Gatti Tassin of Money With Katie, who’s become our own go-to financial guide:

“Everyone has a prenuptial agreement—the difference is between whether you write your own or have the state write it for you.”

And there you have it.

If you want to maintain some autonomy and control over your financial future and keep things a lot simpler in the hellish groundswell that divorce can already be, a prenup is a good idea.

So, we asked Tassin our most pressing questions about creating one.

1. First the most obvious, why do we need a prenup?

“If it's important to you to have a say in how your assets will be split if the marriage is dissolved, it's a good idea to have one,” said Tassin. “If half of homes burned down, you'd probably make sure you had good insurance, right? It's especially important for people who plan to be stay-at-home parents, because you want to make sure you're protected and compensated for your unpaid labor if something happens.”

According to NOLO, an online library of legal information, there are three things a marriage contract can bind you into in the absence of a prenup. These include sharing:

“ownership of most property acquired during the marriage”

“responsibility for either spouse's debts incurred during the marriage”

“management and control of marital property…sometimes including the right to sell or give away the property”

You can imagine how, without having certain protections in place, efforts to split up these elements can get extremely dicey.

2. What does a prenup typically consist of?

A prenup can set up terms and offer a series of protections for each person in the marriage. According to FindLaw, these can include:

Protections against your spouse's debts

Provisions to provide for children from a previous relationship

Protections to ensure family property stays in the family

Protections for estate plans

Descriptions of spousal responsibilities

FindLaw further lists common items addressed in a prenup, which involve how to handle:

Businesses belonging to each partner

Retirement benefits

Household bills and expenses

Joint bank accounts

Credit card spending and payments

Investments and purchases such as a house

Savings contributions

Property distribution if one partner dies

Paying for either person’s education

Method for settling possible disagreements

3. How do you get the ball rolling without it feeling like you're going into business with your future-spouse?

As Tassin points out, “in some ways you are going into business with them—marriage (at the legal level) is just a contract with the state, so treating it with that level of seriousness is actually pretty appropriate.”

Opening up a dialogue with your partner early on is critical, according to Kim Davis of the Fiscal Feminist!, who you can hear brilliantly speak on the matter on the Money With Katie podcast here.

Having these sorts of conversations doesn’t have to undermine the love and trust you feel in your relationship. But it can take some getting used to. The more comfortable you get talking honestly about money with your partner, the better it will be for both of you long-term.

“Talk openly about your expectations first,” said Tassin. “Usually neither party is actively trying to screw over the other (and if someone is...maybe rethink the marriage), so it's unlikely you'll surprise one another with what you feel is fair, but having the conversation to kick off the process can actually reveal money differences you've maybe never discussed before that are absolutely better to air before walking down the aisle and signing on the dotted line!”

Three steps Davis outlined to help couples entering marriage get started on “moneyproofing their relationship,” include:

1. Having the money talk

Davis specifically suggests opening up a dialogue by being forthright and transparent about your own finances and asking your partner these two direct questions:

What are your obligations and debts?

Ask about mortgages, credit card debt, bankruptcies, obligations they have for supporting other people, including child support, alimony, or caring for an elder parent.

What are your assets?

2. Making a budget

In order to invite ongoing transparency and get yourselves into the habit of having regular conversations around money, Davis recommends creating a budget together with realistic goals.

This may sound easier said than done, but just the practice of being forthright and acknowledging who spends, who saves, etc. is going to help set the stage for what might be important to include in a prenup or any financial agreement you enter into as a couple.

Remember, if you don’t do it, the state will.

3. Opening separate trusts

A third recommendation from Davis pre-prenup so to speak, is that each person should have their own property trust of things they owned prior to getting married, which ensures these things are ring-fenced as separate.

4. When do lawyers come into play?

“It might not be necessary to engage lawyers if neither of you hold much in the way of assets or liabilities,” said Tessin. “But otherwise—it's probably wise to first talk with one another about what's important to you to include and then consult a lawyer to write the contract. Prenups are flexible; they can really reflect whatever you want them to.”

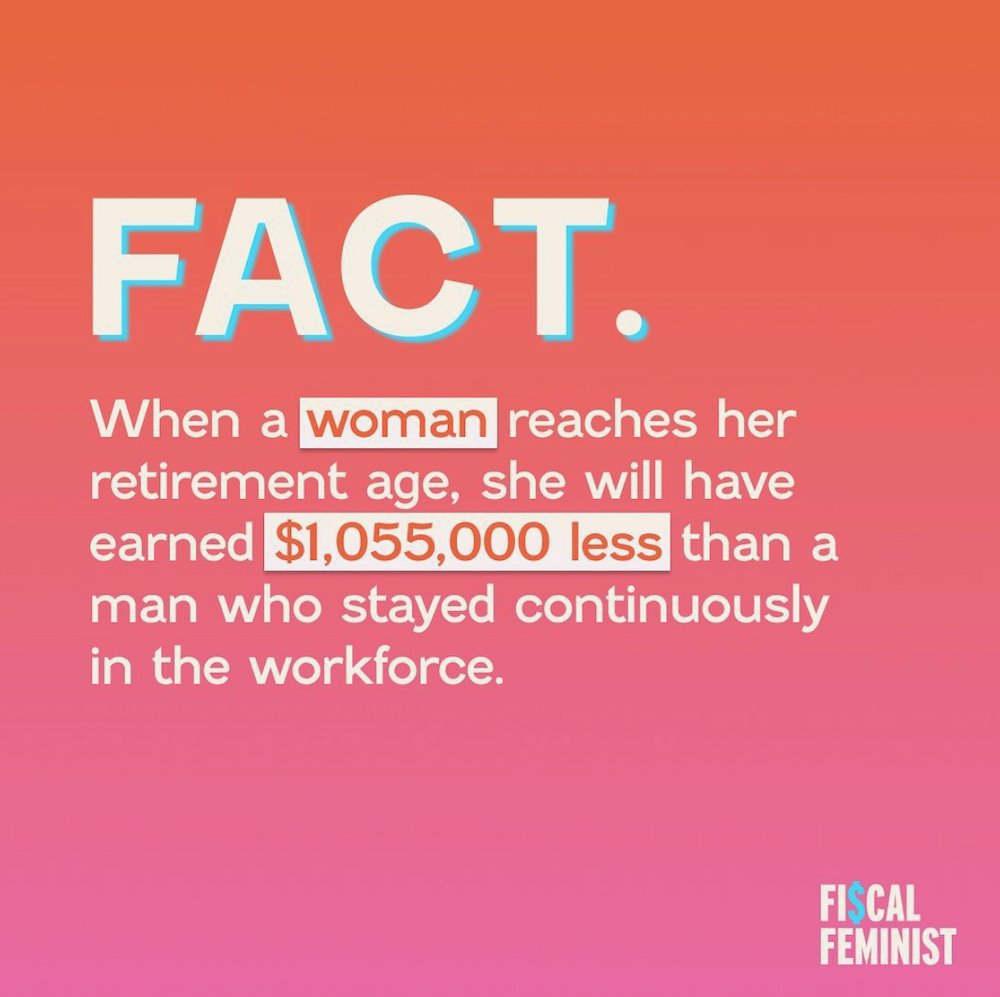

5. What if you’re a stay-at-home parent and not earning income during the marriage?

For a spouse performing “invisible labor,” one element that Davis suggests be agreed upon in the prenup is “a certain amount of money that would be paid out to a stay-at-home mom for every year the mother sacrificed her own career to take care of the house, informed by how much she was giving up in salary and the cost of childcare if they had paid for it from an outside source. This means that, in the event of divorce, she'd be guaranteed a certain amount of their money that otherwise may have been more up in the air.”

This interview has been edited for length and clarity.

This article is for informational purposes only. It is not intended to be used in place of professional advice, medical treatment, or professional care in any way. This article is not intended to be and should not be a substitute for professional care, advice or treatment. Please consult with your physician or healthcare provider before changing any health regimen. This article is not intended to diagnose, treat, or prevent disease of any kind. Read our Terms & Conditions and Privacy Policy.